Coronavirus Disclosures in 10-K filings

- Cognitive Quant

- Mar 11, 2020

- 2 min read

The recent novel coronavirus outbreak has roiled the markets and is in news everywhere. We wanted to explore the extent to which companies were reporting anticipated risks/impacts from coronavirus in the universe of stocks* that we cover. The earliest mention we saw was from LEVI (Levi Strauss & Co) when it filed on Jan 30, 2020 and given how early this was, we can understand they were uncertain about how it would impact them.

Since then until March 6, 2020, we have come across around 760 companies with coronavirus in their filings (out of ~2129) discussing likely risks/impacts from the outbreak

(and in some cases potential drugs/vaccines/equipment/etc. for dealing with the outbreak).

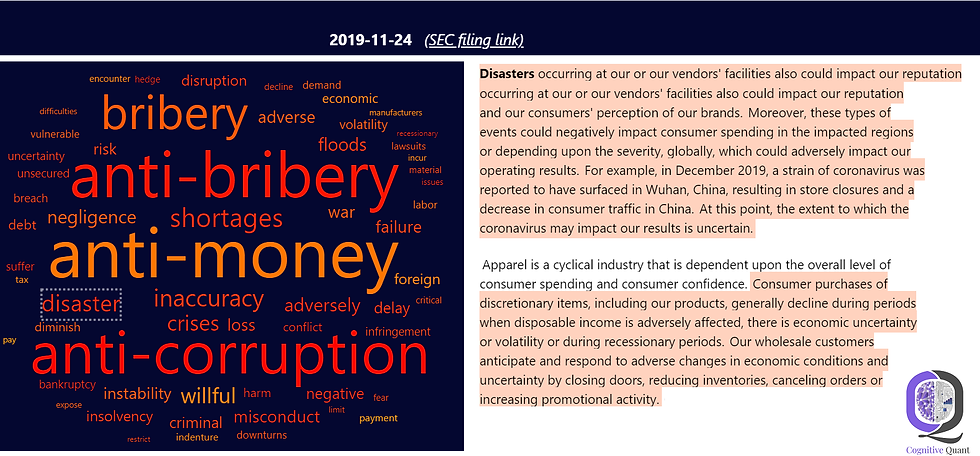

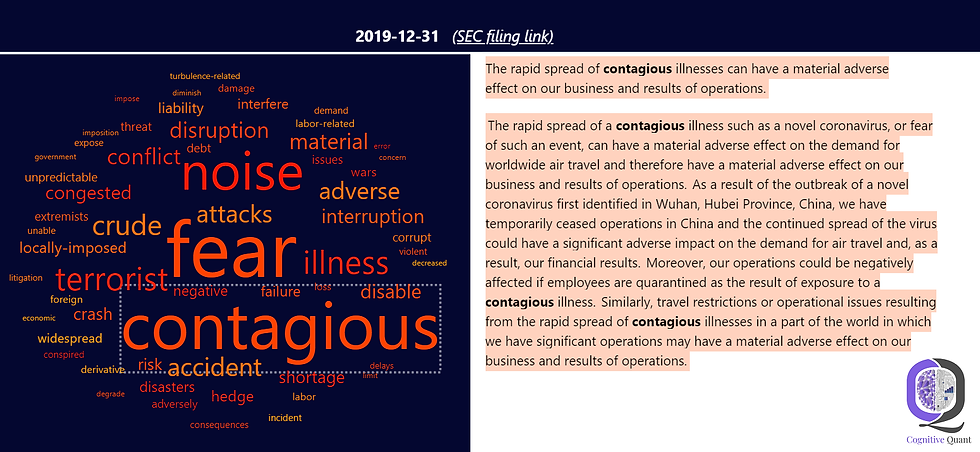

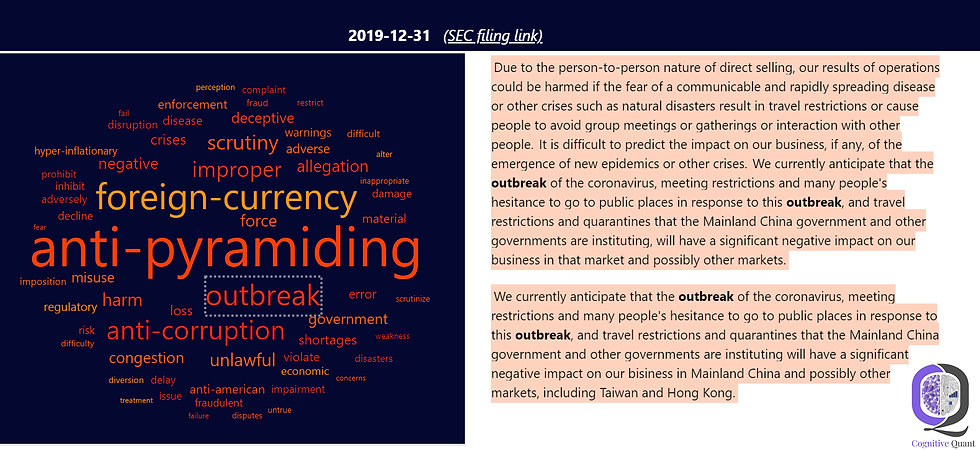

Further, given the greater amount of information available with the passage of time, the wording on likely impacts are (anecdotally) becoming starker as can be seen from the recent 10-K filings for DAL (Delta Air Lines, Inc.) and NUS (Nu Skin Enterprises, Inc.):

Now, even though an impending (and an already materializing) crisis can really drive focus on considering potential risks, as Michael Batnick (at the very insightful Irrelevant Investor) noted some days back -- risk is often what you never see coming ...

And this bears out when we compare the filings for the same set of companies in the prior filing season to assess if they had considered potential risks from pandemics/ epidemics/ other contagious diseases:

So, what are the practical implications for sensible investing?

Simply this: Even though it may be hard to see how, when, or where systemic risks may arise — we can invest with a view to minimize the idiosyncratic (or firm-specific) risks by investing in high quality companies with strong balance sheets and robust business models.

Time is the friend of the wonderful company, the enemy of the mediocre. —Warren Buffet

You can read more about our platform and philosophy in an earlier post.

* Our coverage universe is most US-listed stocks excluding ADRs and OTC stocks.

Comments